We provide legal representation and counseling in all areas of customs law such as:

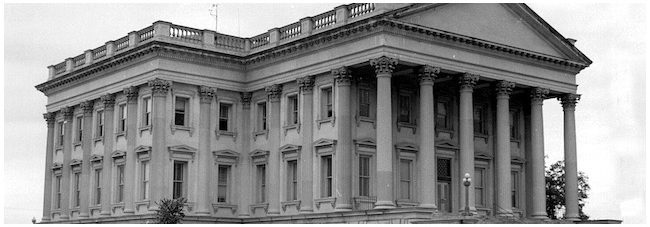

- Litigation of any matter of customs law at the U.S. Court of International Trade and other courts of federal jurisdiction. We can and do appeal unreasonable government agency decisions to the courts, thereby granting our clients’ positions a more considered review by government decision makers, and during the administrative process take steps to preserve our clients’ rights to effective judicial review.

- Experienced, knowledgable and aggressive representation in tariff classification disputes with Customs where large duty payments are involved.

- Counseling on the dutiable valuation of imported goods reported to Customs, including related party transactions and inter-company transfers, the relationship to IRS value for cost of goods sold, valuation of products from Mexican maquiladoras, post-importation value reconciliation, consignment sales, and other goods not subject to a market transaction.

- Representation and counseling during government investigations and audits of a company’s compliance with the customs laws.

- Defending against penalty actions including assessing the costs and benefits of making a prior disclosure, and negotiating the mitigation of penalty amounts including writing an Offer in Compromise to Customs Chief Counsel explaining the litigation risks to the government.

- U.S. Customs enforcement of intellectual property rights at the border, to include representation of either the IP owner facing counterfeit imports or the importer whose goods are seized for alleged IP infringement.

- Drafting and lobbying for favorable trade legislation including Miscellaneous Tariff Bills, and amendments to the Harmonized Tariff Schedule of the United States.

- Providing written legal opinion letters on all customs law matters to satisfy the statutory reasonable care standard and to serve as an affirmative defense against future penalties.

- Writing ruling requests containing fulsome and effective legal arguments supporting a favorable decision by the government.

- Determining the import and export regulatory requirements applicable to a corporation’s operations and products and assisting in obtaining the necessary licenses and permits. Creating written procedures and conducting training for corporate compliance programs. Auditing existing corporate programs, declarations and transactional data to recommend compliance improvements.

- Identifying, evaluating and implementing duty savings projects including free trade agreement claims, foreign-trade zones, duty drawback, temporary import bonds, and bonded warehouses, among many others.

- Providing written legal opinions as to country of origin for: (1) product marking (including Customs foreign country marking and FTC’s Made in USA claims); (2) qualification under free trade agreements such as NAFTA; and (3) qualification for sales to the U.S. government or for U.S. government financing programs. We also identify sourcing or manufacturing changes that would render an otherwise unqualified product eligible under the applicable rule of origin.

- Evaluating and assisting with corporate participation in all customs programs including ISA, C-TPAT, and reconciliation, among others.

- Obtaining relief from government agency delays detaining shipments at the border, including delays of perishable commodities and goods subject to strict contractual delivery terms.

- Low cost options for assisting with daily procedural and ongoing administrative customs questions.

- Carrier requirements under the customs laws and regulations for all modes of transportation, including express consignment operations.